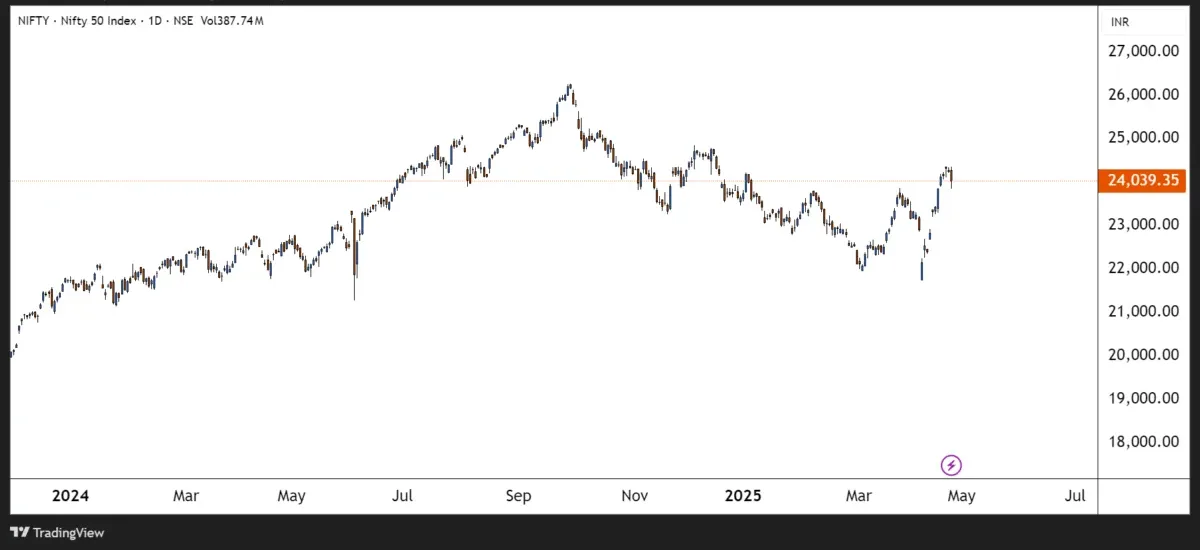

India: Markets Rattled by Kashmir Attack and Global Uncertainty

Indian equities snapped a seven-day winning streak as tensions in Kashmir escalated and investors locked in profits.

Key Highlights:

- Nifty 50 Index fell 0.73% to close at 24,069.20.

- All 13 major sectors ended in the red.

- The small-cap index dropped 2.6%, and mid-caps were down 2.0%.

What Triggered the Dip?

- A deadly militant attack in Kashmir led to fears of diplomatic escalation.

- Indian Army Chief General Upendra Dwivedi visited the region, underscoring the gravity of the situation.

- Market sentiment turned risk-off amid geopolitical uncertainty and global trade worries.

Currency and Flows:

- The Indian rupee recovered from a session low of ₹85.66 to settle near ₹85.25 per dollar, showing resilience.

- Foreign equity inflows totaled $464.4 million on April 23, providing some support.

Looking Ahead: A recent Reuters poll warns of a dimming economic outlook for India. Concerns include potential impacts from U.S. tariffs and weakening business sentiment.

Sources:

Reuters: India economic outlook dims further as US tariffs dent business sentiment

Reuters: Indian benchmarks retreat as Kashmir attack fuels geopolitical concerns

Reuters: Rupee drops; attempt to move past 85/USD blocked by Kashmir attack jitters

United States: Markets Rally on Tariff Hopes and Tech Boost

Wall Street ended the week on a high note, lifted by signs of a possible easing in U.S.-China trade tensions and a blockbuster earnings report from Alphabet.

Key Highlights:

- S&P 500 jumped 2.0% on April 25, powered by post-market optimism following Alphabet’s strong earnings report.

- The U.S. dollar held steady at $1.1350 per euro and ¥143 per dollar, calming after recent swings.

- 10-year Treasury yield remained elevated at 4.3168%, indicating ongoing caution about monetary policy direction.

What’s Driving the Gains?

- Hints of a softer U.S. stance on China tariffs sparked hope for a trade détente.

- Alphabet’s earnings surprise injected confidence into tech stocks and broader markets.

- Despite rhetoric, investors seemed to look past fresh tariff threats, focusing instead on earnings and fundamentals.

Policy Watch:

- Analysts are actively evaluating the Fed’s liquidity tools—including repo operations, the discount window, and potential Treasury buybacks.

- While no action is expected right now, contingency planning is underway should markets face deeper dislocation.

Corporate Spotlight:

- Spirit Airlines gained approval to list on the NYSE American, with trading set for April 29—a notable step in its post-bankruptcy revival.

Sources:

Leave a Reply